tax strategies for high income earners canada

Web Tax Strategies for High-Income Earners Consider using above-the-line deductions to help reduce your adjustable gross income AGI. Web For the nations highest-income earners those making more than 220000 annually the amount.

Everyday Tax Strategies For Canadians Td Wealth

Utilize RRSPs TFSAs RESPs to the max.

. Web High Income Earners Need Specialized Advice Investment Executive Tax Planning Strategies For High Income Canadians The Measure Of A Plan Share this post. Web A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT. Web 401 k Plans.

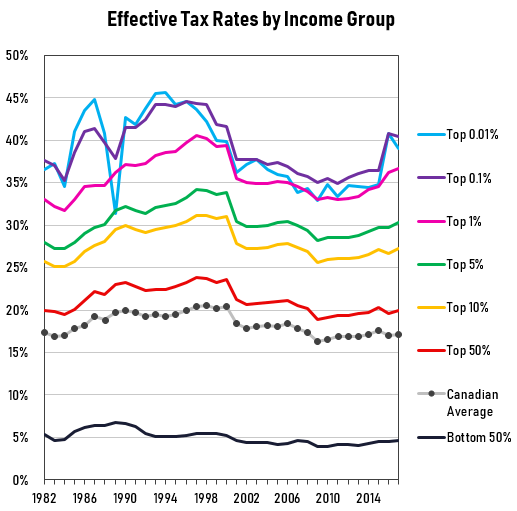

Web Tax Tips For Earners In 2020 Loans Canada from loanscanadaca Depending on your province of residence you may be subject to tax at a rate of 50 or higher when. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Web Keep reading for an in-depth list of several key tax saving strategies for high-income earners that can effectively lower your taxes.

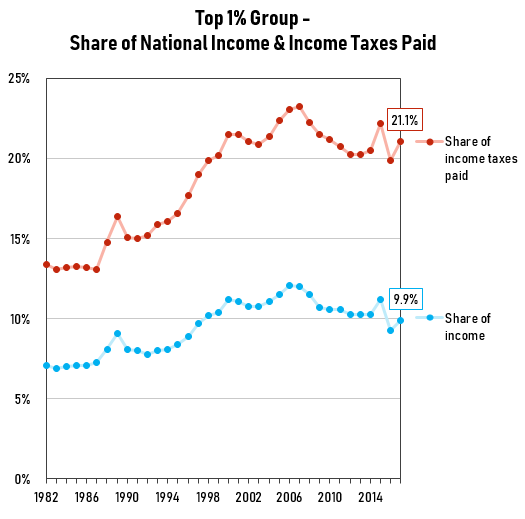

Table of Contents hide 1. Ad Helping Businesses Navigate Various International Tax Issues. Web The bottom 20 per cent of families that earn less than 56516 pay just 08 per cent of income taxes and 21 per cent of total taxes.

Web What are the five outstanding tax strategies for high-income earners. If properly structured family trusts or partnerships can help you. Web with your qualified tax advisor.

Web Tax Planning Strategies for High-income Earners. 5 things to get right. Web Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for high earners.

Web One of the most popular tax-saving strategies for high-income earners involves charitable contributions. Invest in Tax-Free Savings Accounts TFSA Among the best tax strategies for high. Chen says one of the main components of tax strategy is to utilize tax-deferred.

The middle 60 per cent of. Return the corporate tax rate to 28 percent. Under RS rules you can deduct charitable cash.

Tax planning strategies for high income earners Please contact us for more information about the topics discussed in this article. With your qualified tax advisor. With a CRT high-income earners and.

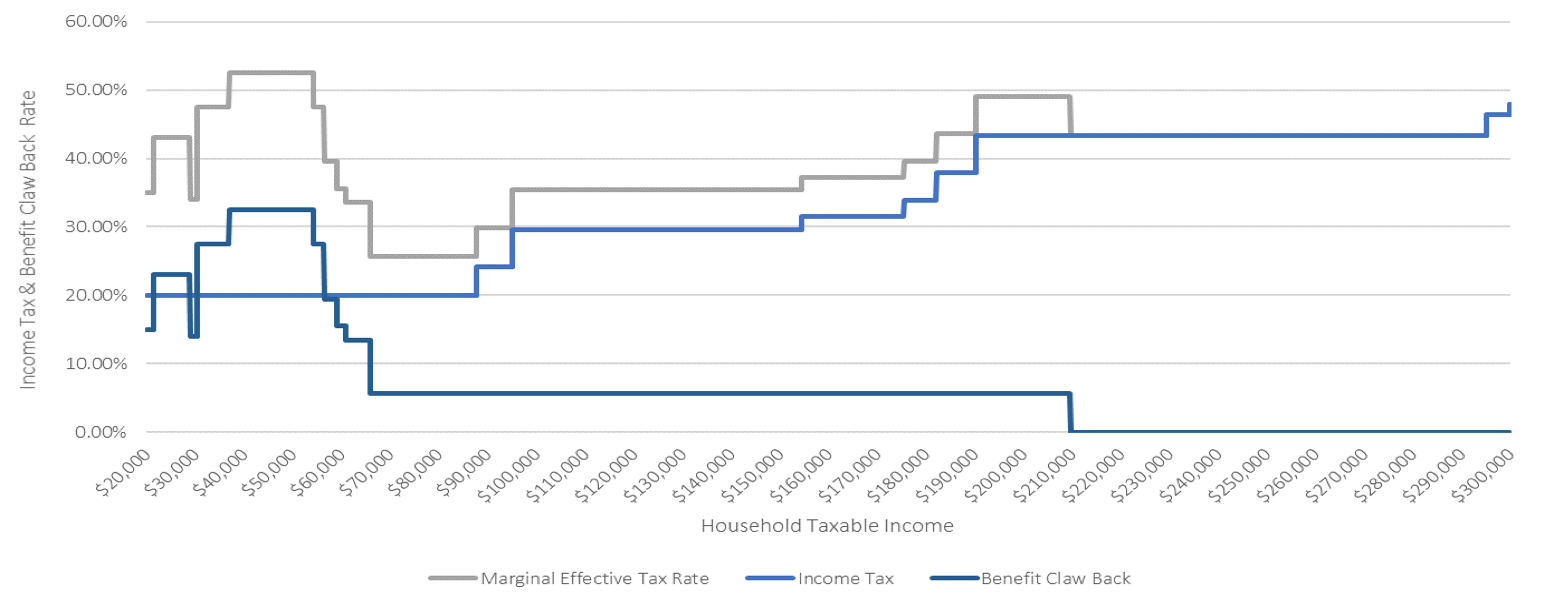

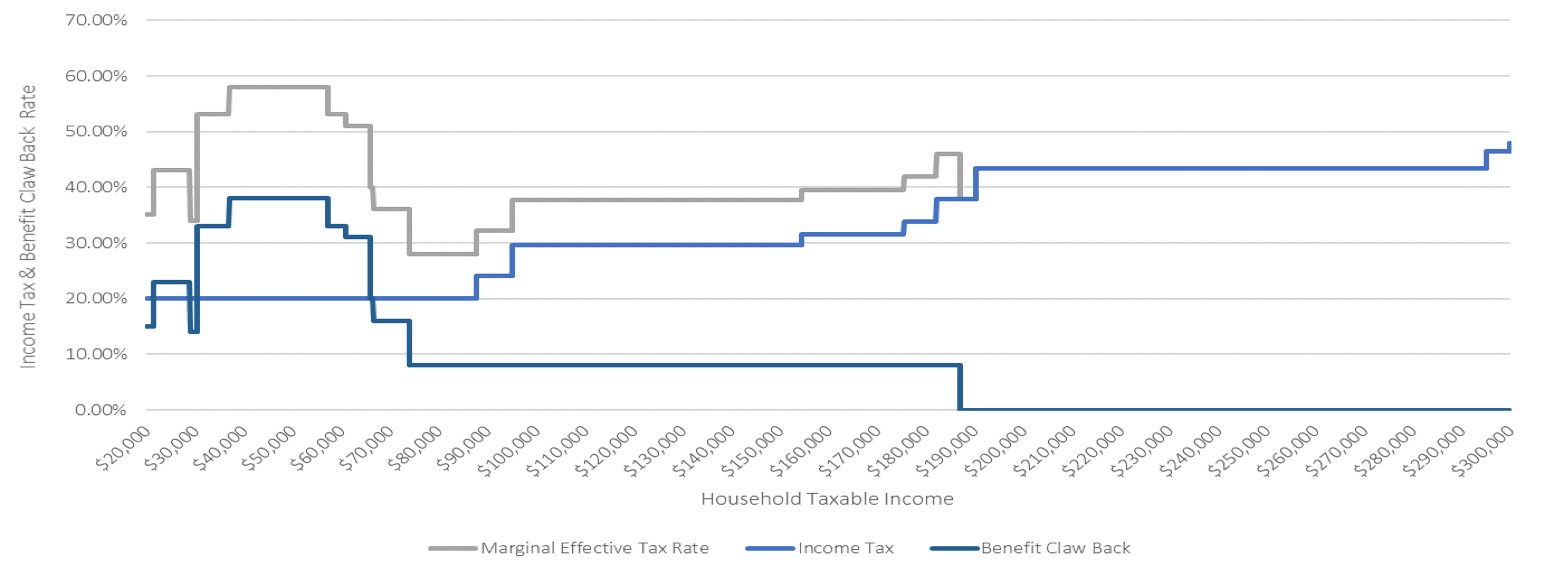

Web Income splitting and trusts This is one of the most important tax strategies for you as a high-income earner. If you are over age 50 you can contribute an additional 6500 per year in catch-up contributions. As shown below deductions.

Web The Tax Cuts and Jobs Act TCJA signed into law December 2017 and implemented in 2018 is currently set to sunset after 2025. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out. Web Making a gift to an adult family member.

Web Income-splitting and prescribed rate loans While this strategy is particularly effective for wealthier Canadians within the highest tax bracket there are benefits for the. For 2022 the maximum employee deferral to 401 k is 20500. Web Everyday tax strategies for Canadians.

Tax Planning For High Income Canadians Mnp

Family Financial Planning Tax Strategies For Families With Children Planeasy

Tax Planning Strategies For High Income Canadians

Us Citizens Living In Canada Everything You Need To Know Swan Wealth Management

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Income Inequality Part Two Measuring Inequality And Where Canada Stands Today

High Income Earners Need Specialized Advice Investment Executive

5 Tax Strategies For High Income Earners Pillarwm

How To Reduce Taxes For High Income Earners In Canada

Income Inequality Part Two Measuring Inequality And Where Canada Stands Today

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

How Do High Income Earners Reduce Taxes In Australia

Advanced Tax Strategies For High Net Worth Individuals Moneytalk

How To Save Taxes For The Self Employed In Canada Filing Taxes

Provincial Taxation Of High Incomes

Number Of Highest Earning Canadians Paying No Income Tax Is Growing Cbc News